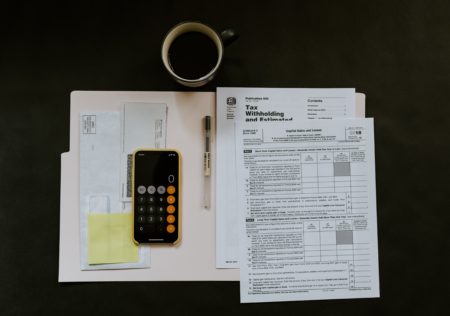

A W9 form is an official tax document used in the United States that provides a freelancer’s taxpayer identification number (TIN) or Social Security number (SSN) to clients who pay them for their services. Clients ask freelancers for a W9 form to comply with Internal Revenue Service (IRS) requirements, as they must report payments made to freelancers to the IRS.

The W9 form includes the freelancer’s legal name, business name (if applicable), address, and TIN or SSN. It is the freelancer’s responsibility to provide accurate information on the form, as any discrepancies could result in problems with the IRS or the client’s accounting records.

It’s important to note that the W9 form is not the same as the W-4 form used by employees to indicate their tax withholding preferences to their employers. Freelancers are self-employed, so they are responsible for paying their own taxes and typically receive a 1099 form from their clients at the end of the year, summarizing the payments made to them.