One of the most sought-after and rapidly growing industries in today’s world is the creative space. Due to the fast-paced nature of our information-rich society, creatives are in high demand, and so is their creative work. And this is why the concept of work for hire comes in.

If you work in the creative field, you must understand the concept of work for hire. Generally, the author of creative work is the automatic copyright holder. However, under the work for hire law, this could change.

This article will discuss what work for hire means, where it applies, and in what ways it can be advantageous or disadvantageous to you as a creator. Buckle up. It’s about to get informative.

What is work for hire?

Work for hire is a doctrine created under the U.S Copyright Law. It refers to work whose ownership has been transferred from the creator to the company that commissioned the work.

General copyright law states that the copyright owner is the author or creator of the work. However, under the work-made-for-hire law, work prepared by an employee within the scope of employment belongs to the employer.

Work done under employment terms is automatically owned by your employer. In other words, if you do some work for your boss within the scope of your employment contract, it belongs to the company that has hired you and not to you, the actual creator.

How an employer can assert the right to work depends on whether you are hired as an employee or as a freelancer (also called an independent contractor).

A work-for-hire agreement is not the same thing as a “contract to hire” agreement which essentially means you agree to work as a contractor for a short period of time with the expectation that, if both parties are satisfied, it will convert into a full-time position.

Consequently, you can request a separate contract and compensation for any work that your employer asks you to do outside your employment contract’s scope. But of course, you would want to do that politely.

We will discuss this in more depth later in the article.

The Importance of a Work for Hire Agreement

A written contract is a vital piece of evidence outlining an agreement between two parties. The main reason to have a work-for-hire contract is to make the ownership of creative work clear. A verbal contract may be okay, but it is best to stick with a written agreement.

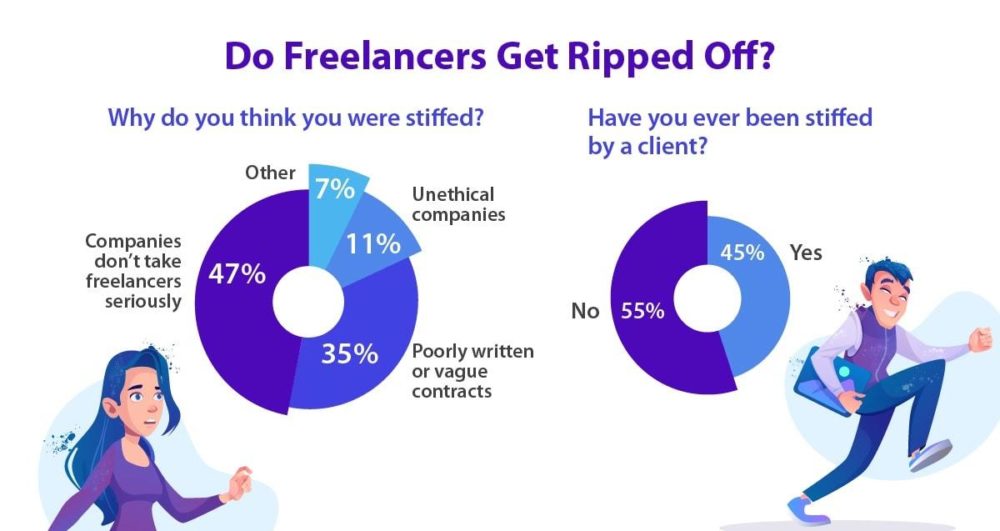

Independent contractors get ripped off too. Dozens of creators have been conned before, as illustrated below in a study compiled by Website Planet.

That being said, there are a few things that you must include in your work for hire agreement. The most important element is compensation. As a freelancer, you must be fairly compensated for giving away your intellectual property rights.

The second most important element is the payment terms. Ensure a payment schedule is in place. Always try to get some of the payment up front and ensure you’re getting paid the minimum wage for the hours you work. That is commonly referred to as a deposit. Additionally, make sure that the client reimburses you for any out-of-pocket costs you may incur as you work on their project.

Be careful to avoid being tied down by the hiring company throughout the copyright duration. You need to include a phrase that indicates that the work made for hire is limited to the services the freelancer is completing for the project.

The above statement will help you make sure that taking on the agreement will not affect your ability to pursue other work as an independent contractor during the life of the agreement.

Here is a list of all the elements you should make sure to include in your work made for hire agreement:

- The scope of the project

- The due date of the project

- Compensation

- The rights to be sold

- Payment terms

- Confidentiality terms (if any)

- Arbitration terms (if any)

- Governing laws

- Non-solicitation

- Non-compete (if any)

- Severability

If your agreement contains all of the above elements, it is not easy for the hiring company to engage in scope creep. Scope creep occurs when the company begins to ask for things and deliverables outside of what was agreed on in the work-for-hire clause.

With a contract in place, you will be able to either renegotiate the agreement in place, or you can finish the work of the current agreement and then negotiate an entirely new agreement with additional payment to cover additional work.

You may be wondering, is it possible to get out of a contract to hire?

The answer is yes, you can. Make sure to include a paragraph noting that it is not an employment agreement and that either party can end the contract.

Anyone can create a work-for-hire agreement. Even an email describing the terms of the work is binding. However, it is best to have a formal document that each party can sign. Remember, when in doubt, consult an attorney.

The Legal Side of Work for Hire

The old US Copyright Act (1976) made it quite easy to convert freelancers’ work into work for hire. A good number of contracts have work-for-hire language left over from that time. Today though, the standards for establishing work made for hire are a lot more stringent.

Keep in mind that there are three basic requirements for copyright protection under the law. It must be a work of authorship, original, and fixed in a tangible medium of expression.

So how will you know if you own your work or not? There are only two ways the work for hire doctrine can apply under today’s statute. First is if you are a regular employee. As discussed before, this will mean that your employer will automatically own any work you do.

The second is if you are not an employee. In this case, your client will own your work only if:

1. Your client specifically commissioned or ordered your work

2. Your contract with your client states clearly that your work is a work for hire

3. Your work was commissioned for use as any of the following:

- A test

- An atlas

- Answer material for a test

- An instructional text

- A compilation

- A contribution to a collective work

- A translation

- Academic articles

- A part of a motion picture or other audio-visual work

- A supplementary work (to another author’s work like a table, chart, or foreword)

It is worth noting that the nature of payment can make the work be considered work for hire. For example, a guaranteed payment indicates that the work is done for hire. An agreement that presents the creator with royalties indicates that the work is not a work made for hire.

The paragraph above sums up what is defined in law as the “instance and expense” test. Every creative work is subjected to determine whether it is a work for hire.

The only way to bring an argument against work determined to be for hire is to have evidence of a contract or written agreement to the contrary. Always save your paperwork. Check the wording and check the grammar before signing the contract.

Uber Technologies Inc found itself in trouble in recent years. To avoid paying employee benefits, the company classified its drivers as contractors. That aggravated many drivers and the public and led to the state of California suing the company.

The Supreme Court has ruled that a stringent test must be used to determine whether a freelancer qualifies to be regarded as an employee. This test is called Community for Creative Non-Violence (v. Reid, 490 U.S 730 (1989)). The factors that must be considered to evaluate the level of control a client has over your work include:

- The commissioned work required significant creative skill

- The client did not have the right to assign additional projects to the artist

- The creator was retained for a short period

- The creator supplied their tools

- The creator performed the work at their studio and not at the client’s workplace

- The work is not part of the client’s regular business

- The client had no role in hiring or paying the creator’s assistants

- The creator was paid a flat fee or royalty rather than an hourly wage

- The client did not control when or how long the creator worked aside from the completion deadlines

- The client is not a business

- The client did not provide employee benefits to the creator or contribute to unemployment insurance or the creator’s compensation fund.

- The client did not treat the creator as an employee for tax purposes.

From the above test, it would be difficult for a company to terminate an independent contractor as an employee. Now that we know what the law states about work for hire let us look at the pros and cons of this arrangement.

The Pros and Cons of Work for Hire

There are many benefits to the work for hire arrangement, but there are some disadvantages. Before you decide to take a particular job, you will need to take time to weigh these pros and cons.

Pros

There are many advantages to working under the work-made-for-hire agreement, both for business owners and freelancers. Let’s look into a few.

Potential to earn more

Under this arrangement, you get to work with as many clients as you would like. That allows you to earn much more than you would if you chose to be employed by only one client.

Lifestyle flexibility

The work-life balance of most gig workers is great on paper. You can decide when to work and when to put work aside and attend to your life duties.

Increased technical and professional knowledge

Freelance work allows you to sharpen your skills. You get to work with clients in different sectors. And it allows you to apply your skills in multiple industries. You can display your client’s projects in your portfolio if your contract allows it.

Freedom from toxic clients

As a freelancer, you get to choose which clients you want to work with and those you prefer not to. That allows you to say no to a toxic employer and take up jobs from companies that truly see and appreciate your value.

Controlled workload

Whether you’re choosing to work from an independent job site or working directly with clients, you can choose how much work to take on at any given time. That is not only empowering but also essential for your mental well-being.

Independence

You are not confined to the dreaded office cubicle from 9:00 am to 5:00 pm. You can work alone and do so wherever you are comfortable.

Company saves money

As an employer, whenever you hire a freelancer, you save on several expenses that would apply to you if you employed a full-time worker. You don’t have to pay employee benefits, pay for office space, provide equipment, pay for insurance, or even pay taxes. You have a lot off your plate by hiring independent workers.

Cons

As it is with life, every beautiful thing has its downside. Here are the disadvantages of a work-for-hire arrangement.

Increased uncertainty

There is no guaranteed job security for you as an independent worker. As the name gig-worker suggests, you are only considered for as long as your services are needed. After completing the agreement (which is mostly a short-term contract), you no longer have a job with the client.

Feelings of loneliness

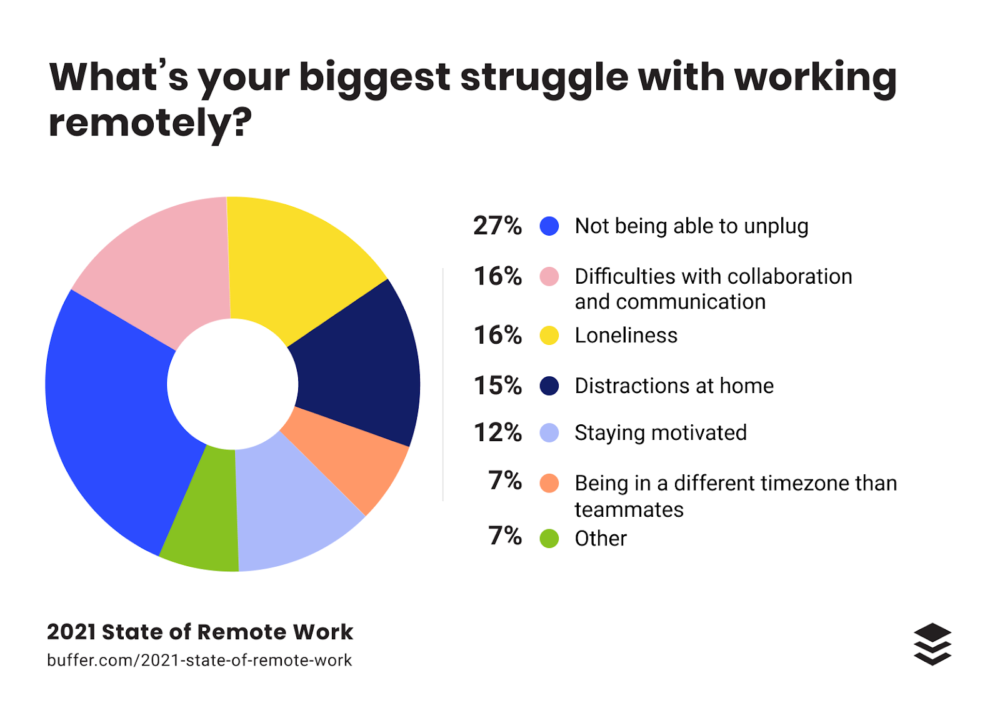

You might feel like an outsider if you’re a freelancer hired by a company with full-time workers. You may feel isolated from your co-workers. Website Planet compiled a study where they found that this is the main struggle of most gig workers, as illustrated below.

The lack of a stronger community was highlighted as the main aspect missing for remote workers. Without a community, detachment occurs, and detachment leads to loneliness.

No free training

You are solely in charge of taking care of your training. While this may sound empowering, it means you have no human resource manager to assist you in choosing the best training for your expertise. You are also in charge of paying for your training all independently.

Full-time employees usually get training paid for by their employers.

Having a hard time knowing when to switch off from work

Many remote workers and freelancers find it difficult to know when to switch off and set work aside for the day. That is illustrated in the following graph.

This can be a problem for freelancers because they have no specified working hours. It causes many to be severely overworked. This may compromise the work-life balance we spoke about earlier.

You may not own the rights to the work produced

When you are working for someone else, that individual or business normally owns the rights to your work. You own it only if you have stated this in the agreement you both signed before the commencement of the work.

Conclusion

Work for hire is defined under the US Copyright Law as work whose ownership has been transferred from the original creator to the company that commissioned the work. The author of any creative work is the automatic owner of the copyright.

However, under the work for hire doctrine of copyright law, work that has been authored by an employee within the scope of their employment contract is owned by the employer or company that commissioned it.

Make sure that you have a contract explicitly stating all the terms of the project you are about to undertake. It must also include a severability clause directing the steps to take when terminating the contract. This agreement is legally binding.

The US Supreme Court has provided a “checklist” by which employers can determine whether workers are classified as employees or as independent workers by the law. That has helped eradicate scope creep, non-payment, and copyright infringement.

With this information and your agreement or contract, you can now boldly work for your clients without any alarm.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!