Whether you find yourself suddenly unemployed or just considering a career change, the question “Should I take a 1099 job?” can be a tricky one.

I still remember taking my eight-year side-hustle full-time and wondering: “should I really be doing this?”

No more W-2s for me. I had officially entered the world of “1099 workers.”

Having survived becoming an independent contractor myself, I can safely give you this advice: relax. It’s not as scary as you might think.

Still, it’s worth considering all your options before you take a 1099 job to ensure you’re making the best choice. You may not even know what a 1099 job is. Or you may understand what it is, but still aren’t sure if it’s a better option than traditional employment.

So in this article, I’d like to shed some light on the biggest reasons for and against taking a 1099 job instead of a traditional employee position (sometimes called W-2).

Short Answer: Should You Take a 1099 Job?

In short, taking a 1099 job is a great way to build up one of two things: (1) side revenue in addition to your day job or (2) revenue for your own small business as an independent contractor.

If you’re pursuing a side-hustle or want to grow your own business, then taking a 1099 job is a great idea.

If not, you may want to reconsider and focus on finding traditional W-2 employment.

Let’s dive a bit deeper into what it means to take a 1099 job and whether or not it is a good fit for your career goals and work style.

To start, let’s find some common ground around what exactly the differences are between a 1099 job and more traditional work.

What exactly is a 1099 Job vs. a Traditional Employee?

When you take a 1099 job, you’re essentially agreeing to be paid as a freelancer or contractor, instead of as an employee.

The term “1099 job” comes from U.S. tax code. In fact, the 1099 form is simply a U.S. tax form primarily used to report income earned by individuals who are not employees, such as independent contractors, freelancers, and self-employed individuals.

In reality, there are around 21 different kinds of 1099s. But for simplicity, the 1099 forms that might impact you the most are 1099-NEC and 1099-MISC.

While we don’t need to dive deep into the meanings of these forms, it’s just important to understand that these tax forms report the income you’ve received from services outside of traditional employment.

Where a full-time employee will receive a W-2 form at the end of the tax year, a freelancer or independent contractor may receive a 1099 form of some kind to report their income.

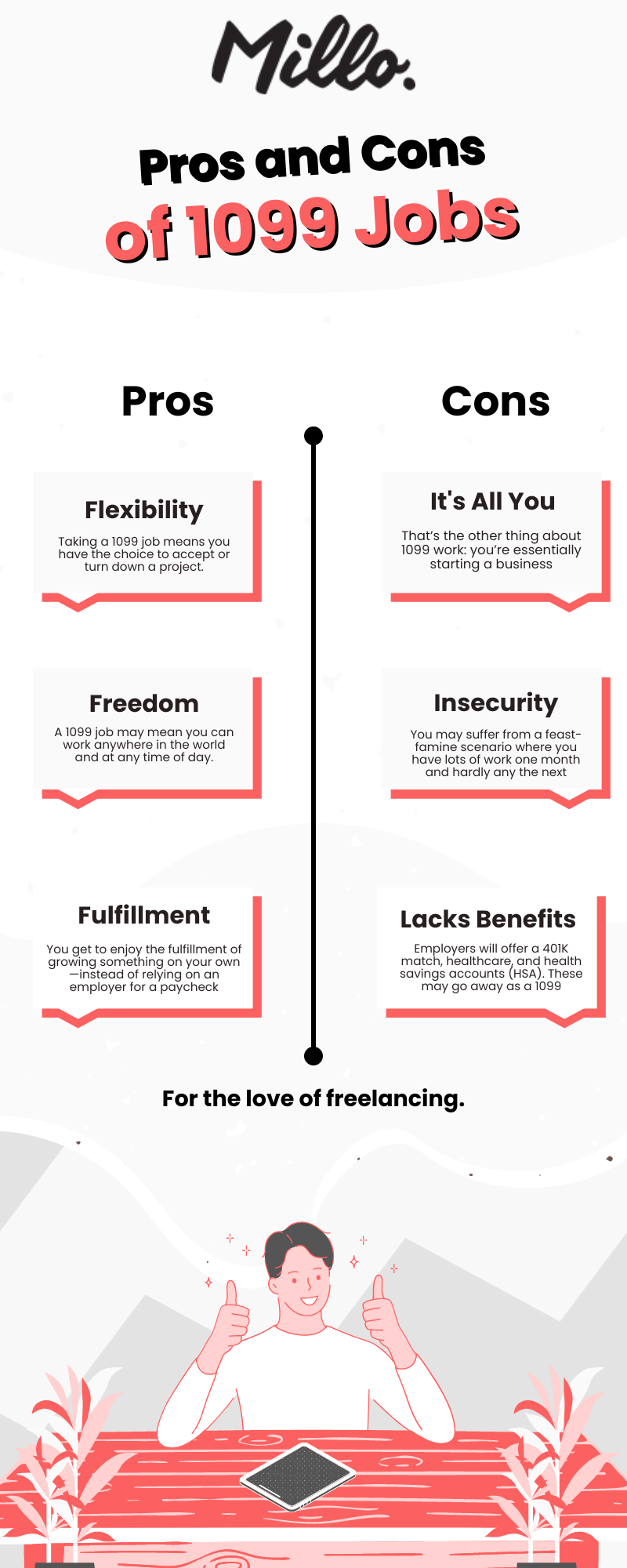

Pros vs Cons of Taking a 1099 Job

There are lots of advantages to taking a 1099 job—and a few downsides worth considering.

First, the positive:

Pros of taking a 1099 Job

There’s lots of upside to working in the gig economy or as a freelancer—which are among the most common 1099 jobs you can find. Here are a few that really stand out:

1. Flexibility to pick projects you enjoy

While a traditional W-2 employee essentially has to do whatever their boss tells them (no matter how much they hate their boss), taking a 1099 job means you have the choice to accept or turn down a project.

So if the project or the client just isn’t a fit, you can politely turn them down and wait for something better to come along.

2. Freedom to work when and where you want

Not only do you get to have more of a say in what kind of work you do, but a 1099 job may mean you can work anywhere in the world and at any time of day.

Typically, when you’re hired as a 1099 worker, you aren’t obligated to follow the same schedule as a traditional employee. Often, there’s no location requirement either.

The year after I started working full-time for myself, my family and I took an entire month off to visit multiple U.S. states and four European countries!

And while some clients may request occasional office visits or a certain number of weekly hours from their freelancers or contractors, the truth is: most don’t. Which means way more freedom for you.

3. Fulfillment in working for yourself

When you’re a 1099 worker, you’re typically your own boss. And while working for yourself isn’t always perfect, it has major advantages.

For example: if you work at a traditional job and do something that brings in a lot of revenue to your employer’s company, you may not see much (if any) of a pay increase.

But when you’re running your own business, things are different. When your business does better financially, YOU do better.

In the first three years after leaving my W-2 job and becoming a 1099 worker, I increased my income by nearly 5 times. Show me a day job where you can do that in just a few years.

Not only that, but you get to enjoy the fulfillment of growing something on your own—instead of relying on an employer for a paycheck.

Cons of taking a 1099 Job

I don’t want to paint everything as a picture-perfect scenario if you take a 1099 job, though.

The truth is, there can be some downsides to being your own boss. Here are a few worth thinking through before you take any new jobs:

1. Everything relies on you to succeed

Typically, when you’re a 1099 worker, the “buck stops” with you. Meaning, everything in your business relies on you to succeed.

That’s the other thing about 1099 work: you’re essentially starting a business. Even if you’re just taking a 1099 job on the side. If you make more than $600 outside of your traditional employment, you’re taxed on it—as additional business income.

That means if you’re sick for a week, there’s no one there picking up the slack. It’s a big commitment. And even though you can graduate quickly from freelancer to founder, there will be a period of time where it’s all on YOU.

2. It may be less secure

Some advocates of “regular” day jobs claim that taking on a 1099 job may be less secure than a traditional job.

For example, you may suffer from a feast-famine scenario where you have lots of work one month and hardly any the next.

You could have a client who ghosts you and becomes completely unresponsive. Even failing to pay their invoices.

Or your word-of-mouth referrals could dry up completely, leaving you without any new business at all.

Note: One of my favorite authors, Chris Guillebeau would disagree here (and so do I). He wrote: “What is risky? Whether you work a ‘real job’ or strike out on your own, relying on someone else is risky.”

3. Lack of traditional benefits

If you’re used to working at a traditional job where you not only receive a paycheck, but also have other benefits, then taking a 1099 job can be a real adjustment.

Often, employers will offer an employer-matched 401K, healthcare subsidies, and health savings accounts (HSA). Not to mention paid time off (PTO) and—in some cases—premium perks like a phone, a vehicle, or sizable bonuses.

When you work as a 1099 worker or independent contractor, many of these benefits go away.

That’s not to say there aren’t options for 1099 workers. It’s just a bit more complicated.

Contractors and freelancers can get a self-employed retirement plan and also have access to health insurance in less-traditional ways.

When I first left the world of traditional employment, I was terrified about losing benefits like healthcare. But it turns out, there are plenty of comparable options for freelancers, contractors, and the self-employed.

How 1099 Taxes Work

If you start taking more 1099 jobs, you’re going to see a pretty significant shift in how you pay your taxes.

For starters (like I mentioned before), you’ll no longer receive a W-2 form (unless you’re keeping your day job while building your side-hustle). Instead, you’ll receive 1099 forms for all the contractor jobs you accept (over $600) during the year.

You’ll then use these forms to calculate your tax liability.

Tax laws can be complex and I definitely recommend consulting with a tax professional (I am not one).

To get you started, here are a few changes you can expect:

You do Your Own Tax Withholding

As a traditional employee, your employer usually withholds taxes from your paycheck and pays them for you.

For example, income taxes, Social Security taxes, and Medicare taxes are usually taken out of your paycheck before you receive it.

But as an independent contractor, you are responsible for setting aside and paying these taxes yourself.

You’ll need to estimate your tax liability and make quarterly estimated tax payments to the IRS throughout the year.

It’s simple. But not automatic like it is when you work for someone else.

You Have to Pay Self-Employment Taxes

When you take on 1099 jobs, you’re technically self-employed. Which means you’re responsible for paying self-employment taxes in addition to your own personal taxes.

That’s because, when you are your own boss, you have to pay both the employer and employee portions of Social Security and Medicare taxes.

This tax is in addition to your regular income tax and is known as Self-Employment Tax.

There are ways, of course, to save on self-employment tax. For example, I signed up for Collective which helped me convert my sole-proprietorship to an LLC—and in the process saves me around $10,000 a year.

You get to take more tax deductions

On the plus side, you’ll have more opportunities for tax deductions compared to traditional employees.

You can deduct eligible business-related expenses like office supplies, equipment, travel expenses, and a portion of your home office expenses.

These deductions can help offset your taxable income which, in some cases, means you actually get to pay less in taxes than if you had a traditional job.

I also recommend you review the best tax deductions for freelancers and self-employed.

Secret Weapon: The QBI Deduction

I’ve saved the best for last. If you’re a 1099 worker, you may have access to something called the “QBI Deduction.”

QBI stands for “Qualified Business Income” and, in short, it’s a tax benefit that helps freelancers and 1099 workers who run their businesses as individuals, partnerships, S corporations, or LLCs.

The QBI Deduction can reduce the amount of money you have to pay in taxes and provide some financial relief.

I suggest you speak with my friends at Collective about it. They set me up and it’s been incredible for my business revenue.

The Verdict: Should You Take a 1099 Job?

After everything I’ve shared with you today, I hope you’re a bit closer to deciding whether taking a 1099 job is right for you.

The truth is: it’s not perhaps as big of a deal as you might think. Taking a 1099 job does not preclude you from taking a traditional job nor does it make your life overly complicated.

But I get it: it’s still an important decision. And one you want to be well-educated about.

If you have any more questions about taking on a 1099 job, I’d love to help over in our facebook group.

If you’re ready to take the leap, then congrats and good luck! I wish you the very best as you explore a work-life with more freedom, flexibility, and fulfillment.

Quiz: Should You Take a 1099 Job?

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!