My first year as a self-employed designer was a frightening whirlwind of stress, uncertainty, and just plain “winging it.” I had years of proven design skills under my belt, but I was suddenly faced with the reality of needing to convert those skills into a real business that made real money.

And if you had asked me how much money I wanted to make during that first year, my answer would’ve been, “As much as I can!” It’s an honest answer, but not one that helped me run a successful business.

Instead I found myself saying, “Yes!” to every project I could find, working too many hours, and eventually burning out. I wasn’t really running my business. It was running me. Something needed to change.

Quick side note:This article is written by Andy, co-founder of Harpoon, the time-tracking, billing, & forecasting software that helps freelancers plan & achieve a yearly financial goal for their businesses. Harpoon offers a 14-day free trial and Millo readers can use the code MILLOTHIRTY for 30% off their first 3 months.

Things started to turn around quickly when I took my first step towards financial stability. “As much money as I can!” wasn’t cutting it. Instead, I set a specific yearly revenue goal for my business.

I figured out exactly how much revenue I needed to generate each year in order to cover my business and personal expenses, make a healthy profit, and live the lifestyle I desired. I was then able to work backwards from my goal, shaping and building my business up to achieve my desired income.

This was one of the keys that helped transform my business from an unpredictable roller coaster ride into a stable, profitable, and enjoyable career.

How to Set a Financial Goal

Setting a financial goal for your business starts with setting your personal goals. Ideally, the business you’re running will generate enough money to support the lifestyle you desire. But how much money will that take?

Take Inventory of Your Lifestyle

Let’s take some inventory of your lifestyle. Whether you’re new to running your own business, or have been at it for years, you probably have at least a general idea of how much money you need to make each month to support your current lifestyle.

But let’s get specific. The more specific you get with the amount of money you need, the more confident you’ll be with running your business, and that includes the types of clients and projects you take on and the amount you need to charge for those projects.

Grab a piece of paper (or your favorite note-taking app) and make two columns. Label the first column, “Business” and the second column, “Personal.” Brainstorm all the different categories of your business and personal life you need to account for, and jot them down in the appropriate columns. Don’t worry about how much money is involved just yet.

In your business column, you might have categories like software, office rent, health insurance, accountant, contractors, etc. In your personal column, you might have categories like groceries, housing, transportation, clothing, childcare, etc.

And don’t limit your categories to expenses only. If your business is simply covering your expenses, then you’re only breaking even. A healthy business is one that can profit and grow.

So you’ll want to include categories that take advantage of a surplus of revenue you’ll be generating that goes beyond simply covering your expenses. These would include categories like savings goals, investments, emergency funds, retirement, charitable giving, side projects, and even vacations.

Once you have a healthy list of categories, you’re ready to start calculating the actual costs involved with those categories.

Calculate Your Yearly Revenue Goal

What we’re ultimately after here is a yearly revenue goal for your business. It’s the amount of money your business needs to bring in each year in order to cover your expenses, make a healthy profit, and support your current lifestyle.

To find this number we’ll start by taking the business and personal categories you brainstormed earlier and assigning a yearly financial amount to each one. This might require a bit of math.

Quick side note: Math might not be everyone’s cup of tea. But don’t sweat it. Just follow along and when you’re ready, simply use Harpoon’s free Yearly Goal Calculator, which handles all the math for you. Nice!

For example, if the office rent for your business is $500/month, its yearly amount would be $6,000. And if your personal grocery bill is $100/week, its yearly amount would be $5,200.

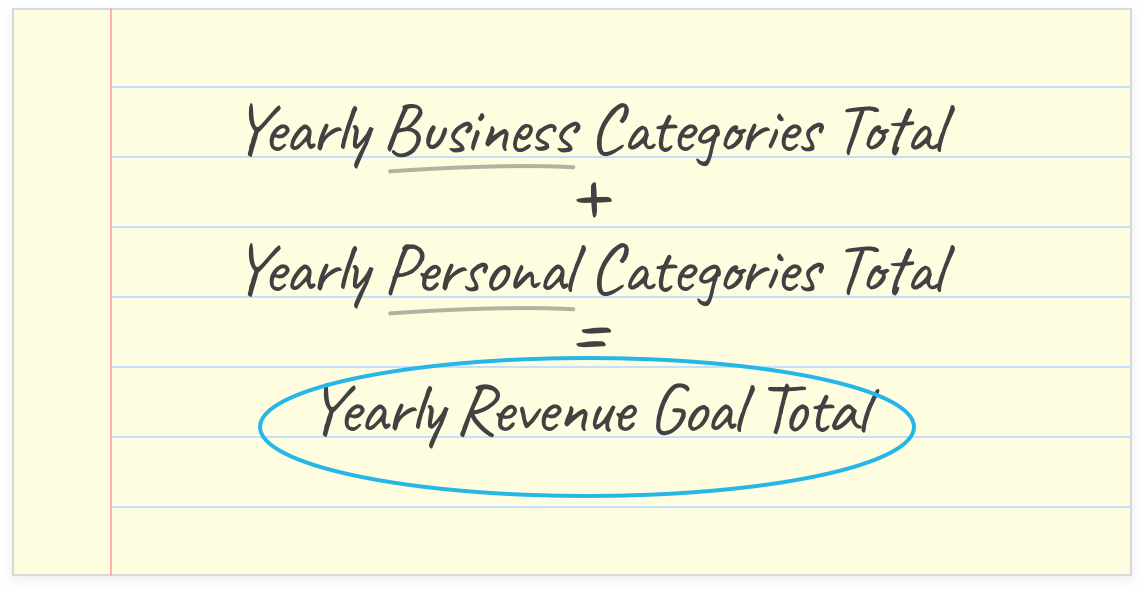

Do this for each of your business and personal categories until you have a yearly amount for each one. Then add together the yearly category amounts to get a total yearly amount for your business and a total yearly amount for your personal life. You can now calculate your yearly revenue goal like so:

But wait. What about taxes? You won’t get to keep all the revenue your business generates. The government will want its cut. So you’ll need to generate even more revenue than you calculated above in order to cover all your category amounts and have enough left over to pay taxes.

(This is where the math gets kind of messy, but thankfully Harpoon’s free Yearly Goal Calculator mentioned earlier will also handle the tax calculations for you.)

Congratulations! You now have a grand total for a yearly revenue goal that covers all of your expenses, includes a healthy profit, supports your current lifestyle, and leaves enough left over to pay your taxes.

At this point, if you’re just starting your business you might be like I was and somewhat intimidated by the yearly revenue goal amount you came up with. I distinctly remember thinking, “There’s no way I can generate that much revenue. That’s way more than I was making as an employee!”

If you’re having similar thoughts here a few things to consider:

- It’s normal that your yearly revenue goal is more than you were making as an employee. In fact it should be much more. You’re the one running the business now, and you need to account for costs that were either hidden or just plain absorbed by your employers in the past. Things like health insurance, office rent, equipment, etc., are big ticket categories that are now your responsibility, and those categories should be accounted for in your yearly revenue goal.

- You always have the option of reducing the amounts needed for your business and personal categories in order to cut costs. It’s up to you to find the right balance between the plushness of your lifestyle vs. how hard you think you’ll need (or want) to work.

- It’s healthy to have a yearly revenue goal that feels a bit out of reach. You’ll find yourself building your business up to the level of your goal, making decisions that foster better projects, better clients, and ultimately a more profitable business.

What’s Next?

You’ve figured out your yearly revenue goal. But a goal isn’t worth much without an actionable plan to achieve it. And that’s where a product like Harpoon comes into play.

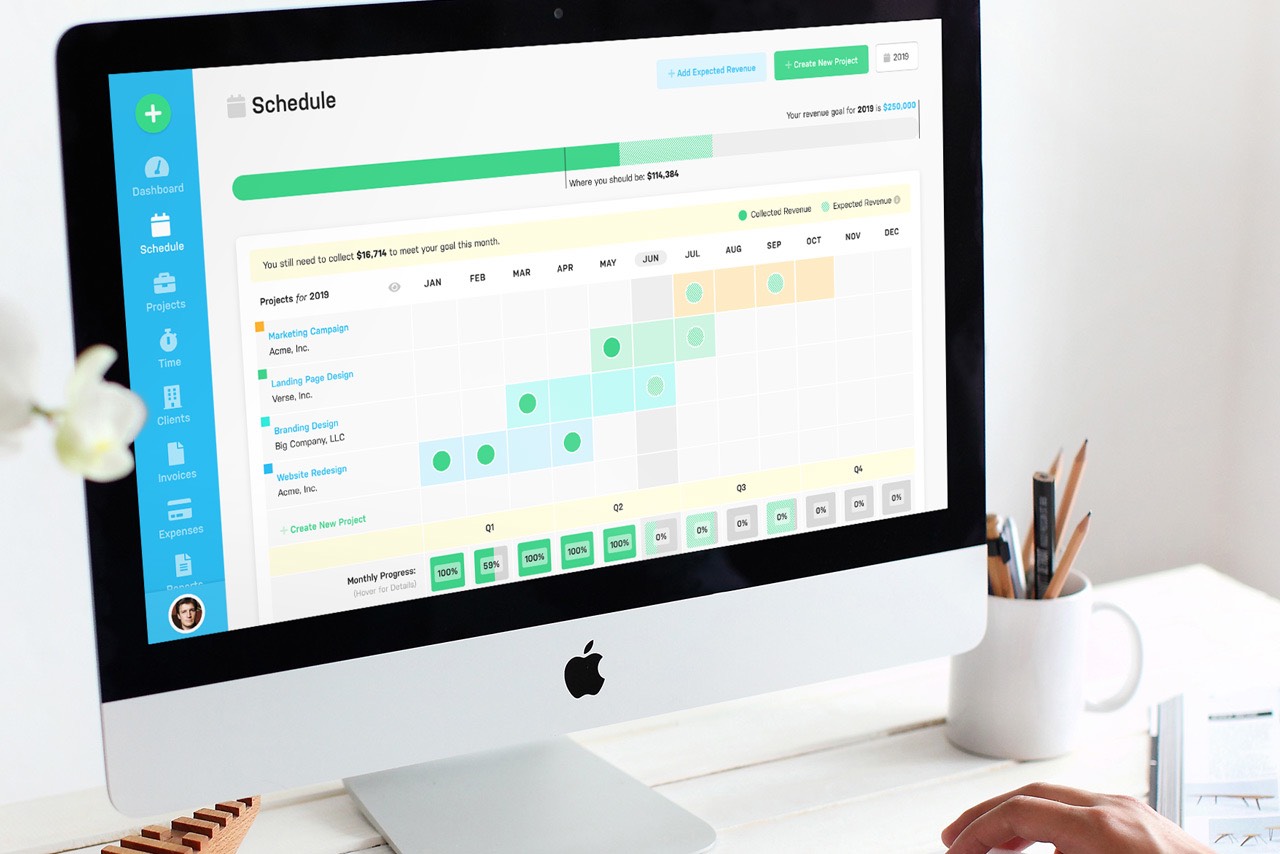

Harpoon takes your yearly revenue goal and breaks it down into a dynamic monthly goal that automatically adjusts throughout the year based on the amount of revenue you’re collecting from your clients from month to month.

Harpoon then allows you to map out your client projects on a yearly schedule and automatically forecasts how much revenue you expect receive, and when you can expect to receive it. So you’ll always know ahead of time when and where to schedule new client projects in order to stay on track to achieving your financial goals.

Aside from goal-tracking and forecasting Harpoon provides all the other tools you need to keep your freelancing finances in tip top shape including:

- Time Tracking: A frictionless time-tracking system that provides the exact value, cost, and potential profit of every hour you record for your client projects.

- Invoicing: With scheduling and automated sending of invoices, automated recurring invoices, and auto-billing of your clients’ credit cards, prepare to have some extra time on your hands.

- Projects: Easily create budgets, set schedules, manage team members, share notes, track time & expenses, and predict profitability for all of your client projects.

- Expenses: Automatically track your business expense transactions, set spending budgets for each category, and generate expense reports for your accountant.

- Analytics & Reports: With dozens of real-time business metrics, dashboards, and reports, no other product helps you keep a pulse on your freelancing finances like Harpoon does.

Whether or not you choose to use a product like Harpoon, I highly encourage you to take that big step towards financial stability by calculating your own yearly revenue goal.

You’ll have peace of mind knowing exactly how much income you need to generate each year in order to cover your business and personal expenses, make a healthy profit, and live the lifestyle you desire. Happy freelancing!

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!