Do you know how to send an invoice as a freelancer? Every service-based business has to deal with invoicing, and sometimes it can be more complicated than you think. Getting paid on time as a freelancer is a critical part of the invoicing process as it leads to more predictable cash flow and helps your business to stay afloat.

If you’re not sure how to send an invoice and get paid in a timely manner, this article is a great start. We’ll cover everything you need to know about how to send an invoice!

Do this first before you send an invoice

Before you do anything, be sure to go over these 3 important details to decide your invoice terms. Without the right timing, terms, and payment type, you lessen your chances of getting paid.

Get the timing right

Making sure the timing is right is the first thing you want to do before sending your invoice. Most of the time, you will send an invoice upon the successful completion of a service or immediately after purchase.

Alternatively, you can use the first/last invoicing method that implies sending invoices at the beginning or at the end of the month. Lastly, you can send out invoices based on the clients’ needs and preferences (upon request or by mutual agreement).

Determine your terms

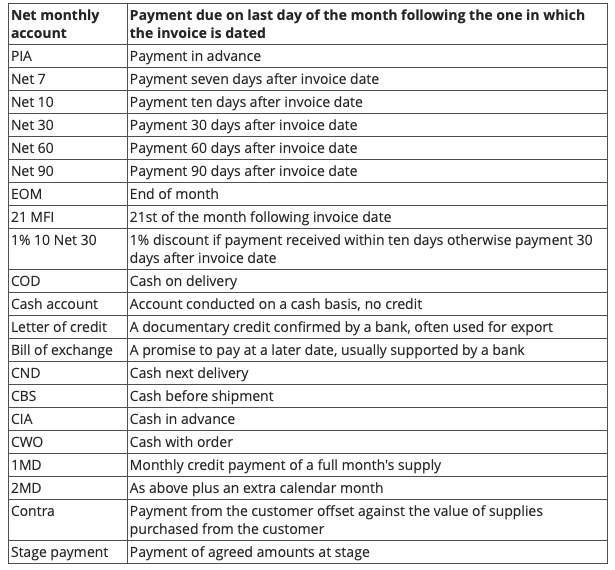

Establishing your invoice payment terms and conditions is another thing you want to do before sending out your invoices.

The invoice payment terms and conditions are particularly important because they will impact how long it will take for you to get paid. Use this list as a reference when establishing your invoice payment policies.

Besides, you’ll have to identify how to handle past-due invoices. Sometimes, your invoices won’t be paid on time, and it’s certainly helpful to have a strategy for these cases.

After you’ve decided on the invoice payment terms, you have to learn to create a professional invoice. If you’re not particularly sure how to create one, this article is a great source. You’ll learn how to send an invoice, how to write an invoice email and a follow-up.

As a bonus, you will find the best hands-on tips that will help you get quicker payments.

Please, note that this article does not cover invoicing basics. If you want to learn more about invoicing fundamentals, check out this article.

Figure out how to get paid

The final important step is identifying how you’ll get paid. Typically, once your customer makes the invoice payment, an Account Payable department (a department that handles incoming invoices) must confirm the validity of the invoice and categorize it.

Then, the invoice is forwarded to a person responsible for that specific invoice. This person (typically the department head) must confirm that the amount on the invoice was stated correctly.

Once all of these steps are completed, the invoice will be confirmed and recorded into your company’s accounting system.

Sounds pretty complicated, right? The good news is that there are lots of great freelancer invoicing apps out there designed to automate this process. We recommend FreshBooks, Bonsai, Lili or QuickBooks for the simplest solutions.

With these apps, you won’t have to worry about anything, as all steps, from the arrival of the invoice to the money transfer to your business account, are fully automated and don’t require your personal attention.

How to send an invoice once you’re ready

Once you’ve done all of the aforementioned steps, it’s time to figure out how to send an invoice. There are two main ways to send invoices — by traditional mail and with the help of electronic delivery.

Snail mailing paper invoices is typically a much slower method (usually takes from three to five business days to reach a customer). Still, it does have its own advantages for particular groups of customers.

For example, snail mail is a perfect delivery invoice method for customers who have poor eyesight or don’t know how to use computers.

Issuing online invoices is the quickest way to get paid. Besides, this way is more sustainable and cost-efficient as you will reduce the use of paper. Additionally, issuing online invoices helps to eliminate banking frauds typically associated with paper invoices.

Invoice software enables you to optimize and automate your invoicing process. Yet, it’s easy to get lost in countless invoicing tools. To help you make the right choice, we’ve gathered a list of the four best invoice software to consider.

FreshBooks

FreshBooks is an all-in-one invoicing and accounting software that addresses the needs of small business and freelancer invoicing. FreshBooks’ invoice generator allows you to create professionally looking and customized invoices.

When it comes to payment options, you can accept credit cards and ACH payments to get paid faster. Additionally, the platform enables you to organize expenses, manage multiple projects simultaneously, and keep track of your performance with financial analytics reports.

Fiverr Workspace

Fiverr Workspace is Fiverr’s invoicing tool aimed primarily at freelance professionals. Fiverr Workspace works by automatically generating invoices and alerting you when your clients have viewed the invoices or completed the payment.

The payment options (including credit cards and ACH payments) are embedded into invoices for faster payment.

Fiverr Workspace offers many advanced invoicing features. So, you can customize invoices, receive money in different currencies, apply discounts, set an invoice in milestones, or set up recurring invoices.

Bonsai

Bonsai is the final invoicing software closing our list. Bonsai is a freelancer-oriented invoice tool that auto-generates invoices based on proposals or contacts you create in their system.

You can also set up notifications that will let you know when clients see your invoices. Additionally, Bonsai automatically sends out follow-ups to clients who failed to pay their invoices on time.

It’s important to always give your customers a choice. Make sure to ask your clients which invoice delivery method works best for them. While both methods have their pros and cons, your customers must be the ones who have the final say.

Lili

Lili is a banking solution truly made for freelancers. Packed with features that freelancers will love, like no minimum monthly balance and no monthly service fees. Think Lili might be too niche? They have all the great perks of a national bank, such as mobile check deposits, a mobile banking app, and a VISA debit card for easy purchasing. On top of that, easily manage your freelance business expenses on the fly, and set up a “Tax Bucket” — a set percentage of your income you choose to set aside for taxes.

Its Lili Pro plan helps you create, manage and organize your invoices from the Lili app. Click here to sign up for Lili or learn more in our Lili Bank and App Review.

How to send an invoice email & follow up

The most common way to deliver invoices is by email. This makes absolute sense because half of the global population have email accounts. So, if you have chosen email as your invoice delivery method, the next step is figuring out how to write an invoice email.

Just like any other email, your invoice email must include the following elements:

- A clear subject line

- A greeting

- The main body

- Your signature

- An invoice as an attachment (not as an email copy)

When it comes to creating a subject line, the best practice is to include the key invoice information within. Here is an example of a typical subject line for an invoice email:

Invoice for [product or service provided] # [the number of the invoice] due [date]

Make sure to personalize a greeting with the customer’s first name. Here are the most common and professional ways to welcome customers in the invoice email:

“Dear [customer’s name]”

“Dear [Position title]”

“Hi [company name or customer’s name]”

The best practice here is to make your greeting consistent with your brand’s tone of voice while staying professional.

The body of your invoice email must be written in a friendly and professional tone. Make sure to include the following information in your body:

- The total amount due

- The due date

- Terms and conditions (if applicable)

- Payment overdue policy

Finish your email copy with a professional signature. Make sure to mention your name, position title, and company name.

Email template for sending your invoice

When creating your email copy for sending the initial invoice, use this example as a reference — where the information in brackets is what you’ll swap.

Subject line: Invoice for [Flyer Design] # 1 due [10/15/20]

Hi [Jane],

I hope you’re doing well! Please see the attached invoice number 1 for the [Flyer Design] due on [10/15/20]. Don’t hesitate to reach out if you have any questions!

Kind regards,

[Jerry Smith

Graphic Designer

JS Designs]

Follow-up email template

Sometimes, you’ll have to send out follow up emails reminding your customers that their invoices are due soon.

Use this example of a follow-up email as a reference when creating your email copy.

Subject line: Reminder: Invoice for [Flyer Design] # 1 due [10/15/20]

Dear [Jane],

Just a reminder that we have not received a payment for invoice number 1 for the [Flyer Design] due on [10/15/20]. You will find the invoice in the attachment. Don’t hesitate to reach out if you have any questions!

Kind regards,

[Jerry Smith

Graphic Designer

JS Designs]

Failure to pay your invoice email template

Keep in mind that there will be times when your customers fail to pay for the service on time. In this case, you must have a template for payment overdue email to avoid being rude by accident when asking for payment.

Here is an example of a payment overdue email:

Subject line: Overdue invoice for [product/service] # 1 due [date]

Dear [Jane],

This is just a quick reminder that [$125] in respect of invoice number 1 was due for payment on [10/15/20]. We would be very grateful if you could let us know when we can expect to receive the payment. Please, don’t hesitate to reach out if you have any questions or concerns!

Kind regards,

[Jerry Smith

Graphic Designer

JS Designs]

If you are still having trouble with getting paid, read about what to do when a client doesn’t pay for a more in-depth look of how to handle these situations.

4 Bonus invoicing tips to help send a better invoice

It can be frustrating when your customers fail to meet invoice payment deadlines and expectations. By following these tips, you will ensure that your hard work is recognized by your customers as they pay you timely.

Automate the invoicing process

Instead of sending out invoices manually, automate the invoicing process with the help of dedicated invoice software. Some invoicing software, like FreshBooks, Bonsai, and Fiverr Workspace. They are specialized by industry, so make sure to do the research and find the most suited accounting software for your type of business.

Set clear payment terms up front

Setting clear payment terms upfront is another thing you can do to get paid faster. You must discuss the payment terms with the client before providing a service/product. Also, make sure to be specific with the payment timeline and outline the specifics within your invoice.

Offer extra benefits for early or on-time invoice payments

Customers always appreciate additional benefits. Offering a little of something extra is a great way to facilitate on-time payments. For example, you can offer a discount on the next invoice for early payment.

Make it unbelievably convenient to pay an invoice

If you want your customers to pay you on time, you must make the invoice payment process more convenient. This includes enabling your customers to pay from their mobile devices, as well as offering more types of payment methods. Work on developing closer relationships with customers

If your customers know and relate to your brand, they’ll appreciate your need to be paid on time. Invest time and resources into building meaningful relationships with your clients.

Final thoughts

Invoices are an essential part of any business, including freelancing, and knowing how to manage freelancer invoicing is paramount for optimal business success.

The good news is that the invoicing process doesn’t have to be as frustrating as it may seem at first. Following the aforementioned tips will help you send out effective invoices that will keep your cash flow going.

With all that said, now you’re ready to send out those invoices!

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!