If you are one of the roughly 59 million gig workers in the US, it is up to you to be familiar with every aspect of running your own business. Of course that includes the skills that got you into business in the first place, like designing, writing, coding, accounting, etc. But it also includes the less fun pieces of entrepreneurship like writing proposals, invoicing, and of course, paying taxes.

And taxes are stressful.

Figuring out how to do taxes as a freelancer has added complications, like multiple 1099s, self-employment regulations, quarterly deadlines and tracking expenses. Add to that the whiplash of an ever-evolving tax code, and you may start to feel like understanding taxes is impossible.

If you’re stressed about filing your taxes this year, there are an abundance of resources available to help you decode the tax code. In this article, we’ll walk you through some of the considerations in determining and scheduling tax payments and give you some tools to help.

Determining if you have to pay taxes as a freelancer

Before you ask how to do taxes as a freelancer, you have to ask yourself if it is even necessary. If you are just getting started in business or if freelancing is more of a hobby for you, there’s a chance you don’t even owe taxes.

For all self-employed individuals, once you have earned $400 or more, you must start paying taxes on that income. Even if you earn less than $400 from an individual client, if your total income is above that threshold, you must pay taxes on it.

You should receive a 1099 form from each client you work with (more on that later), that will help you in filing taxes, but it’s vital to track your own income with detailed reports so that you can compare your earnings with what clients report.

To be clear, even if you earn less than $400, you may still need to file a tax return. If you have other income sources, if you have earned money through gambling or prize money of any kind, receive child support payments, are earning interest on investments or or have credits to claim, among other reasons, you still need to file a return. If there’s a question, go ahead and file. The IRS will not charge you if your income does not meet the guideline, and you may even be entitled to a tax credit or refund.

To ensure you know how to do taxes as a freelancer and are filing the correct forms, you may consider consulting a professional or using a handy tracking tool like Keeper Tax.

When to pay your taxes

For most people, taxes come around once a year.

When learning how to do taxes as a freelancer, you will find it is a bit more complicated—because of course it is. That familiar April 15th deadline still applies, but in some cases, freelancers also owe an estimated quarterly tax.

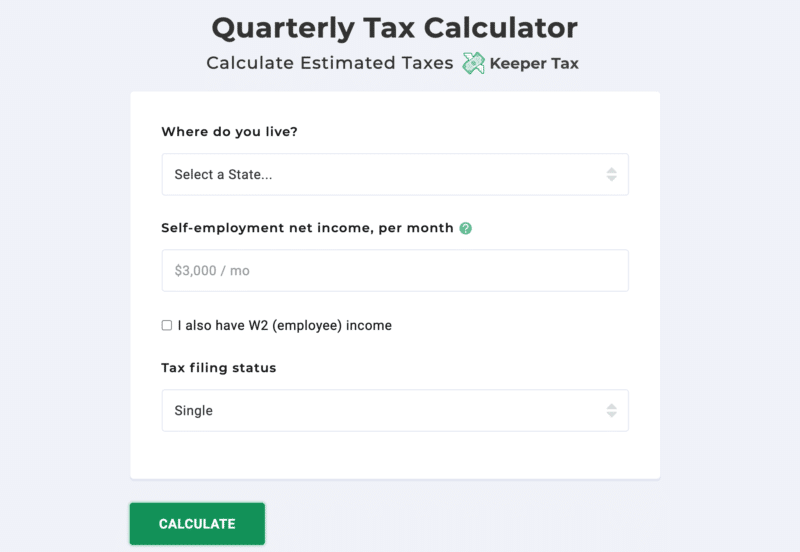

If your total tax payment is likely to be more than $1000 at the end of the year, you fall into this quarterly tax payment group. The payment depends on a variety of factors, including your individual income, your household income, and the state you live in.

It sounds like a lot, but it’s really not as complicated as it sounds. You can use an estimated tax calculator to determine a ballpark estimate of your quarterly payments and learn more about how to do taxes as a freelancer.

If quarterly payments concern you, there are also a couple of ways to help manage them.

- Credit overpayments from the previous year. If you are eligible for a tax refund, you can elect to apply that amount to your next year’s taxes. You should definitely consult a tax professional before going this route, because it is complicated and not always the right choice. However, it can help alleviate some of your tax burden and lower your quarterly payments for the coming year.

- Withhold tax payments from W2 income. If you have a full-time job, or if your spouse is paid on a W2, you can elect to have extra tax withheld from their paycheck. This form of payment supersedes quarterly payments and you can rest easy until the April filing deadline.

How to do taxes as a freelancer in 7 steps

So now you know if you need to pay taxes, and you’ve calculated your quarterly payment schedule. Let’s get into the details of how to do taxes as a freelancer.

Determine your business structure

Freelancers can set up their business a few different ways. The two most common are a sole proprietorship and an LLC. A sole proprietorship just means a single individual (you) runs a business (your freelance income).

An LLC is a bit more complex and requires official paperwork to set up. The main benefit of incorporating as an LLC is to limit your tax liability. LLC actually stands for limited liability company. As the owner of an LLC, you are doing business separate from your personal finances.

What does this have to do with learning how to do taxes as a freelancer? If you are operating under an LLC, you’ll file taxes under the LLC and pay those taxes from a separate self-employed bank account. As a sole proprietor, you use your personal name and bank account to file your return. So it’s important to know the pros and cons of both and how to make the shift if needed.

Understand freelance taxes and forms

If you’ve held a job as a working professional, or even took a high school economics class, you are probably familiar with W4s and W2s.

Freelance taxes have a whole different set of paperwork and procedures associated with them. So you’re fully armed with the knowledge of how to do taxes as a freelancer when tax season rolls around, let’s go over the highlights:

- 1099-MISC: The 1099 form is to a freelancer what the W2 is to a full-time, benefited employee. A 1099 is sent to you by clients for work that exceeds $600 annually. You’ll start to get 1099s in January––businesses are legally obligated to send these forms out before February 1st, so you should have paperwork from all of your clients by the middle of February. If you don’t and you believe you should, it’s time to start making phone calls.It’s very important to save all of your 1099 paperwork. Exactly how you do taxes as a freelancer is up to you, but keeping organized files will be a life-saver when it’s time to file.

- Schedule C: The Schedule C, or Form 1040, is the bread and butter of how to do taxes as a freelancer. This is the form you use to report income or loss from any business, whether you operate as an LLC or Sole Proprietor. If you have more than one business, you need to file a Schedule C form for each one of those entities.On the Schedule C, you’ll enter your gross revenue, any refunds you’ve granted, interest earned, tax credits you have already received, expenses, commissions, fees, payments you have made to employees or other contractors, property depreciation estimates, insurance premiums, mortgage payments for a business property (not your home), legal and accounting fees, maintenance costs, and certain taxes and licensing fees.That’s a lot of information that you need to have prepared ahead of time. Whether you hire a professional or take the task on yourself, using an expense tracking app can make the process a lot easier.

- Self-employment taxes: When you work for someone else as a payroll employee, the company you work for is required to withhold Medicare and Social Security taxes from your paycheck each month. This money helps fund those programs, and allows you to draw from them as you age.If you are self-employed, these taxes are not withheld, so you owe them on the back end. That is essentially where self-employment taxes come from. Unlike income tax, self-employment tax does not apply at the state level, so this portion of your tax is fairly predictable. Budget for 15.3% of your earnings for this federal tax.

Stay on top of your finances throughout the year

This is the most important part of knowing how to do taxes as a freelancer the right way. It is nearly impossible to submit an accurate tax return without accurate records and receipts.

Your best bet is to use simple accounting software to track income and expenses as you go. This way, nothing gets left out and you have all the paperwork you need to back up your claims at the end of the year.

Our top tool to help you with these tasks is Bonsai. It allows you to track 1099 expenses & keep peace of mind at tax time.

Bonsai auto-imports expenses from bank and credit cards, then classify and track them on web and mobile apps.

This tool was built exclusively for self-employed workers to track expenses, maximize tax write-offs, and estimate quarterly taxes.

Have a dedicated business bank account

If your business is an LLC, a separate bank account for your business is a legal necessity. But for sole proprietors, it might still make sense.

Having a dedicated bank account is an easy way to track all income and expenses, since the bank will keep records for you. It also provides some financial protection, and allows multiple people to manage the business finances as you grow.

Understand all of your possible tax deductions

As a business owner, at the same time you report your income, you can show the IRS how much it costs to run your company, and you won’t owe taxes on those expenses.

Taking these write-offs is essential in helping you keep your hard-earned money and allowing you to invest further in your business.

In addition to physical expenses, you can deduct certain things like car mileage, meals, your cell phone and internet expenses (as they relate to your business), and a home office.

I could write an entire article on expenses alone, but here are some of the most common ones to consider.

Consider hiring a tax professional

If you haven’t figured it out by now, taxes are fairly complex. Just as you are an expert in your field, accountants are experts at what they do. They generally have a college degree and certified CPAs have to take a difficult test and keep up with the latest laws and trends in order to maintain their license.

Filing your own taxes is a good way to save money if you are just starting out or only wondering how to do taxes as a freelancer so you can continue a side hobby. However, as you scale your business, working with a professional bookkeeper could actually save you money in the long run, since they will help you catch all of your deductions and avoid fines if you miss a payment.

Think about retirement

While you’ve got a CPA on the line to talk about your taxes, it might be a good time to sort out your retirement options. Odds are you don’t want to work as a freelancer forever, and without an employer-sponsored 401k, you need to take on the planning yourself.

Set aside money each month for taxes and retirement. You can set up automatic payments to separate bank accounts or sub accounts of your personal and business accounts, so this earmarked money will be saved before you even see it.

There are tax benefits to both a 401k and IRA accounts, so be sure to review those options and decide what works best for you.

Ready to tackle your taxes?

Most of us spend a decent amount of time wondering how to do taxes as a freelancer, especially as you’re starting up your business.

While there is a bit of a learning curve, taxes are not something that should keep you from pursuing your freelancing goals. With a bit of research, careful bookkeeping, and potentially some outside help, you can tackle self-employment taxes and find a lot of satisfaction in working on your own.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!