The question of being a freelance vs employee is more important to the modern workforce than ever before. 2021 came to be defined as the year of the Great Resignation. According to the U.S. Bureau of Labor Statistics an estimated four million Americans quit their jobs in July 2021 alone. Question is: where did such a large workforce go?

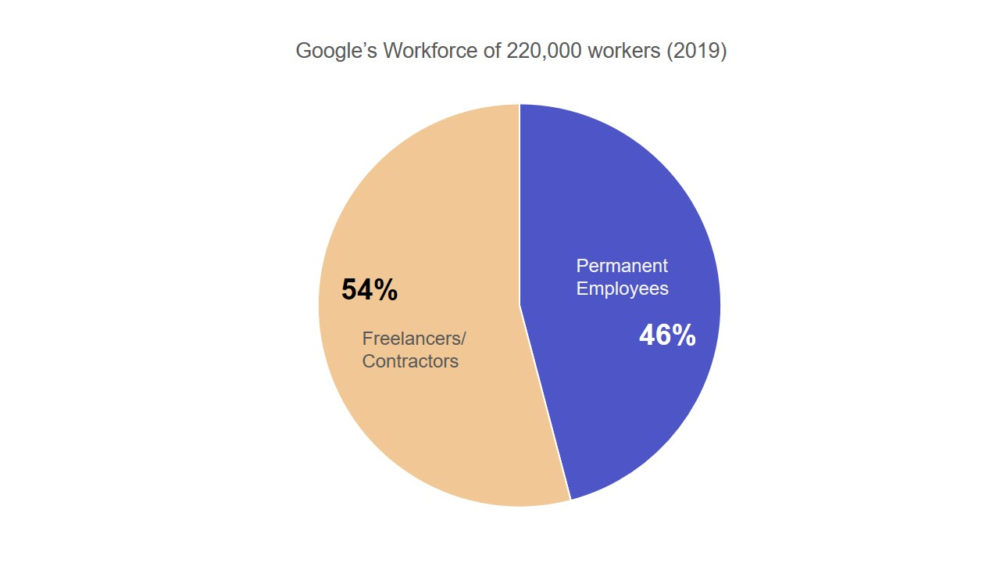

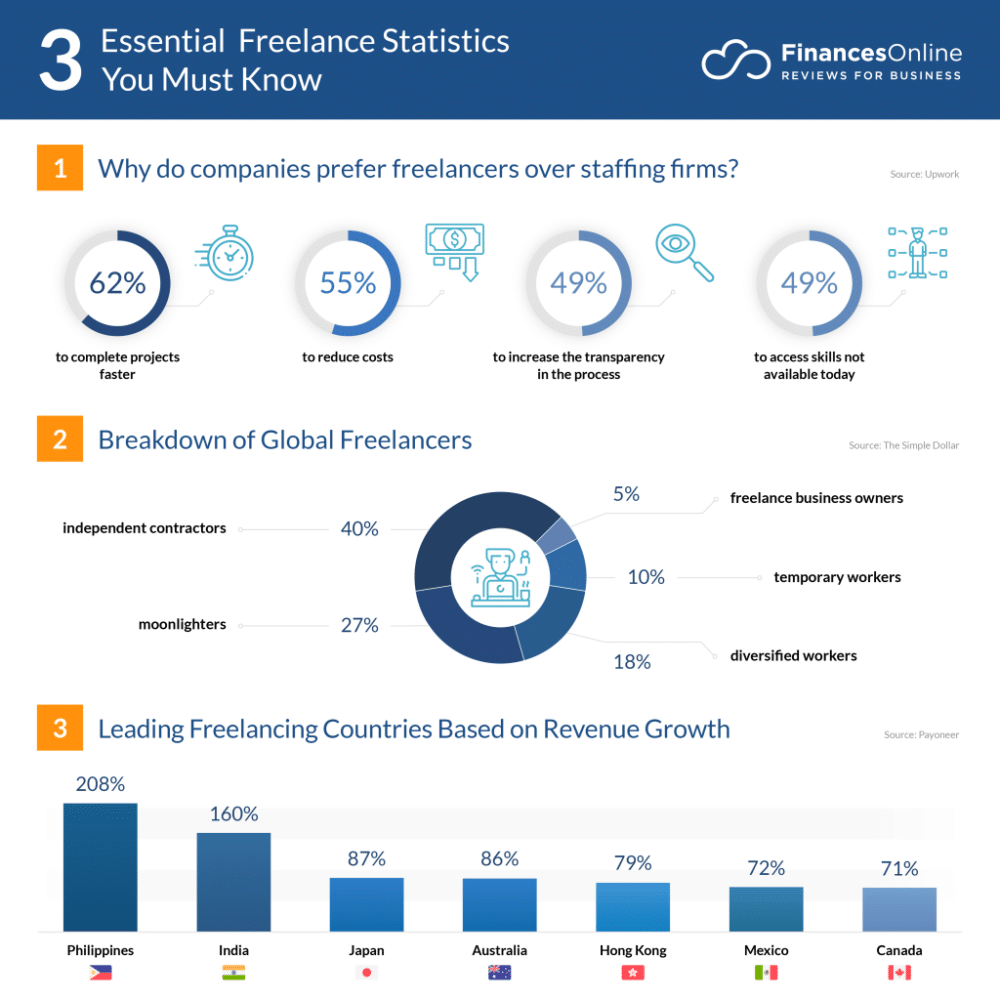

There is a sizable population of freelancers that has been growing steadily over the last few years. A recent report by freelancing platform Upwork shows that freelancers have contributed a whopping $1.3 trillion in annual earnings to the American economy in 2021.

Freelance work, that was at one time reserved almost exclusively for creative professionals, has gradually made its way into nearly every line of work from IT and finance to consultancy, law and more. A growing number of professionals are now choosing to switch from fixed term employment contracts to freelance.

But is freelance going to be the dominant choice for all work in future? Before we delve into that discussion, let’s first consider the alternative – being an employee. In spite of the great workforce exodus that we witnessed last year, employment rates in the US grew to 59.5% in December 2021 up from 58.4% in July last year.

Freelance vs Employee: What is the Difference?

The freelance vs employee debate is a long standing one that has intensified over the last few years – as more and more people make the choice to leave full time employment. But what exactly is freelance and what kind of work can you do as a freelancer?

Freelance

Freelance work means you are not exclusively tied to one company or employer. Instead, you work for multiple clients and get paid on a per-project or per-day basis as opposed to getting a fixed pay cheque every month. Most creative freelancers work alone and enter into different contracts with individual clients.

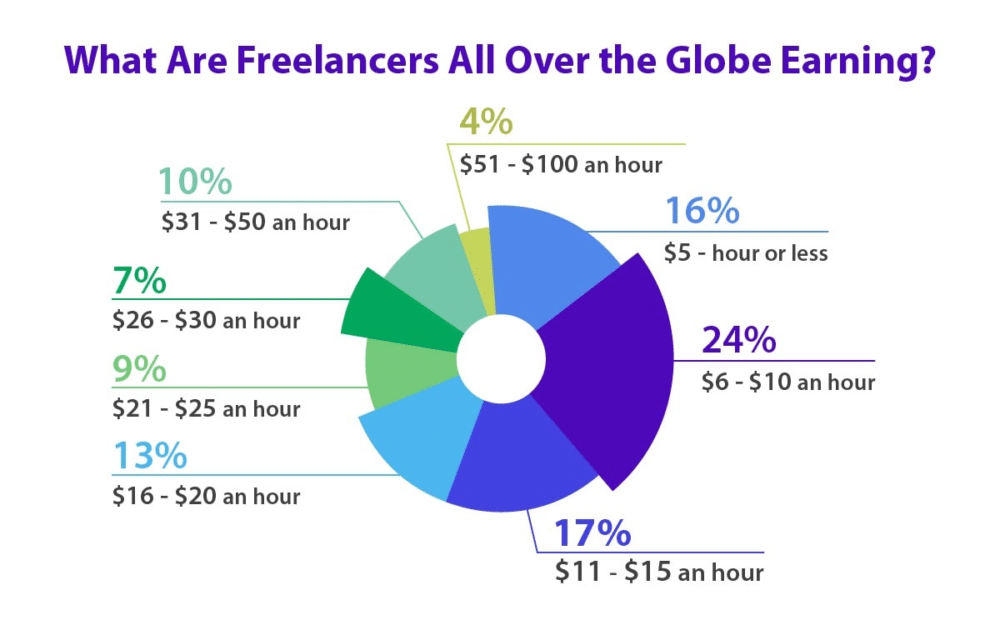

For example – a freelance copywriter can choose to work for Client A on a project basis, but fix a per-word rate of pay with Client B. Freelancers set their own rates and hours of work. And, because they aren’t tied to any one employer, they can take on multiple clients. Freelancers also most often file their own taxes, although some companies do make tax deductions before paying them.

One of the greatest perks of having a freelance job is that you can often do it in tandem with a regular job. As long as there’s no conflict of interest between the two or the terms of your contract at the day job don’t forbid it, you can always take on an additional gig. For example – you may work as an accountant at a bank but freelance as a photographer on weekends.

Most people who want to venture into a freelance career try and test the waters first by taking on a gig alongside their regular jobs, this way they get a feel of what it’s like without jeopardizing the security of their main source of income.

One of the main reasons for the growing preference for freelance is the flexibility it provides in the way you work. For many people, working 9-5, five days a week is not a viable arrangement. This could be for multiple reasons ranging from care responsibilities at home to different needs or simply because you need a different work-life balance.

Freelance provides the option to choose where you work from, how long you work for and even which days you work. This is a great way to fit work around other commitments. Also, with freelance you can decline work without appearing rude simply because it doesn’t suit your needs or schedule.

Now let’s consider the alternative of freelance: life as an employee.

Employee

An employee is anyone who is hired by a company to perform preset tasks. Employees work exclusively for one company and get paid a fixed salary monthly, weekly or fortnightly. Unlike freelancers, regular employees don’t have the flexibility to choose their hours of work. As soon as they enter into a contract with an employer, they are bound to abide by its terms.

These include minimum weekly working hours. For full time work this is usually between 35-40 hours per week. More and more companies are now adopting remote or at least hybrid work that involves a mix of home and office.

As an employee, you have to follow the company policy on this and if it requires you to commute to work three days a week, you need to comply. Some organizations are using tools like employee hours trackers to ensure you stay on task.

Freelance vs Employee: Which is Better?

Now that we’ve established what freelance is and who an employee is, it’s time to address the elephant in the room: which is better? Sadly, there’s no clear answer.

A freelancer and an employee each have their own merits as well as downsides. Understanding the pros and cons for both scenarios is important when choosing between freelance vs employee.

Pros of being a Freelancer

We’ve already looked at the major benefits of being a freelancer. To recap, these include:

- Flexibility in choosing your own hours and your rate of pay

- Freedom to choose the kind of projects you accept

- Option to do freelance work alongside your regular job

- Freedom to do what you love

- Freedom to be your own boss

Now let’s consider some of the cons of freelance:

No fixed income

For a freelancer, income is typically dependent on the volume of work they produce. So if you happened to have a lower output one month, this would be reflected in that month’s earnings. This makes it hard to plan and arrange for living costs which in contrast are usually fixed.

No Sick Pay

One of the biggest downsides to working as a freelancer is that you’re not entitled to company benefits extended to regular employees. This includes sick pay. As an employee who gets a fixed salary, their written or verbal contract includes provisions for sick leave. For freelancers, if you don’t do the work, you don’t get paid.

The same can be said about general paid leave. An employee can take time off for a holiday or any other personal reason and still receive the same pay at month’s end. For a freelancer, there’s no such option. Should they choose to take ‘time off’, it would involve forgoing their earning potential for that period.

You’re on Your Own

Another downside to freelancing is that it involves working alone for the most part. So if you’re someone who enjoys the social aspect of work and collaborating with colleagues, you might find it a bit lonely being a freelancer.

Let’s looks at the main benefits of an employee

Guaranteed Fixed Income

This is the reason so many people choose to work for a company on a permanent basis. The financial security of a fixed pay cheque often tilts the scale in favor of employees vs freelancers. Since employees don’t get paid per project or per day, the volume of work they end up producing per month doesn’t really impact their income.

Freelancers often, if they don’t have adequate experience or industry contacts, struggle to find enough work to sustain themselves. Employees don’t have this problem as their work is assigned by their employers.

Benefits Package

Most employees have access to a range of company benefits that include paid time off, health insurance, pension contributions, and other perks and discounts. Nowadays companies are offering personal development funds as incentives to employees.

These include upskilling courses that employees can use to advance their careers even after leaving their present company. Freelance doesn’t have any such benefits.

Cons of being an employee

Limited Flexibility

With the growing popularity of remote working, traditional employees now have some degree of flexibility in the way they work. So, an employee can have the flexibility to work from home two days a week and use a cloud based phone service to join team meetings remotely.

However this flexibility is limited and doesn’t include choosing the number of hours you want to work.

So you could have the flexibility of choosing where you work but you’d still have to put in the numbers of hours stipulated in your contract.

Furthermore, freelancers have the freedom to accept or decline any work that they’re offered. Employees don’t have that choice. For example – a freelance content writer given a brief to write about the glare of laptop light could refuse to do it. A writer who is an employee of a company can’t do that.

Capped Earnings Potential

As an employee you enter into a fixed income contract with a company. This salary can be periodically reviewed but remains unchanged in the short run. This means your potential for earnings is capped at a certain amount. This can be a disadvantage particularly for professions that have lucrative day rates.

As a freelancer you don’t have the security of an assured monthly income, but the potential for earnings is unlimited.

We’ve looked at the pros and cons of both freelancer and employee. But how can you decide what’s best for you in the freelance vs employee debate?

8 Tips to help you decide between freelance vs employee

1. Dealing with Financial Insecurity

One of the first questions you need to ask yourself is whether you’re capable of dealing with financial insecurity or if you need the assurance of a fixed monthly income. This is one of the main deciding factors in the freelance vs employee debate. As discussed earlier in this article, earnings from freelance can vary significantly.

Your income is directly tied to the volume of work you produce in a given period. Without the guarantee of a fixed income it’s difficult to account for fixed living expenses and can lead to serious financial difficulties if you’re not careful. On the flipside, freelance comes with the potential for much greater earnings. Essentially: greater the risk, bigger the returns. Question is, are you willing to take that chance?

2. Being Disciplined

Working as a freelancer comes with the challenge of maintaining discipline in your work and break schedules. Not everyone can effectively manage their workload without some form of supervision or guidance.

If considering a freelance career, you need to be honest with yourself about your self-discipline and set and follow a rigid work routine that allows you to fulfill deadlines.

Whether it’s being on time for virtual meetings or delivering a website design by the agreed time, punctuality is key for success in freelance.

Freelance work does provide flexibility in choosing your own hours. However, it involves delivering projects by designated timelines. If you fail to deliver, you could potentially lose a client and this automatically has an impact on your income.

Bonus Tip: If you need HR software development services, visit jatapp.com for the best possible solution.

3. Network

As a freelancer you’re responsible for securing your own clients and projects. So the onus is on you to network and connect with people. In today’s competitive world, most working professionals use networking platforms like LinkedIn to grow their connections and meet other people from their respective fields. This is great for seeking out new opportunities.

For freelancers in particular, this networking is an ongoing process that continues beyond business hours. Ask yourself if this is something you can do before deciding on a freelance path.

4. Make Provisions for Sick Days

As discussed earlier employees have access to a variety of company benefits that include paid leave. Freelancers need to make provisions for any sick days or leave they want to take to make sure their incomes aren’t affected by this. This could be by way of savings or taking on additional work at another time.

While deciding between the freelance vs employee route you need to decide if you’re able to make these provisions. Remember, most of your living expenses are fixed even if your income is variable. So you need to make sure you’re covered for the times that you might be away.

5. Managing Taxes

Most freelancers are self employed. This means they need to manage their own taxes, as opposed to regular employees who get their taxes deducted at source by the companies they work for. Managing your taxes doesn’t have to be a daunting task. You do however need to do your research to make sure you’re complying with local tax laws. Maybe seek advice from a qualified accountant.

When you choose to work as a freelancer, this is the kind of administrative work you need to do by yourself.

6. Evaluate Your Lifestyle

In the debate of freelance vs employee, you need to first evaluate your lifestyle and then decide the style of work that is best suited to your needs. For example – if you’re unable to commit to a 9-5 schedule five days a week, and need the flexibility to fit your work around other commitments, freelance is probably a good option for you.

Often, people pursuing a full time academic degree or those who have other personal commitments during the day find it easier to work in the evenings and on weekends. Freelance work is ideal for this.

7 .Working Alone

As mentioned earlier, freelance is by and large a solo gig. Some people can work well independently and don’t need the supervision of a manager or socializing with colleagues. However, not everybody is the same. Some prefer the collaborative nature of work and enjoy fraternizing with team members.

Even as more and more businesses adopt remote working and are setting up their staff with remote software tools at home, some are missing working alongside their peers in a shared space. For freelance, this is a serious consideration if you don’t enjoy working alone.

8. Test the Waters

Finally, to decide the best option for you, a good rule of thumb is to try freelance alongside your regular job. This way you get a taste for both and can decide which works better for you. It’s a safer approach that provides financial security while you actively experience life on the other side.

To Sum Up

In this article we looked at two different approaches to work – freelance vs employee. We explored the pros and cons of each and also looked at eight tips to choose the best option for you.

The best option is naturally going to be different for different people depending on their individual situations in life. However, with the right planning and time management, you can try both and experience the best of both worlds.

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!